'Married puts' - foundation of a profit machine (part 2)

Continuing the series, part 2 looks at intrinsic value, further reduction of risk, and choosing a strike price.

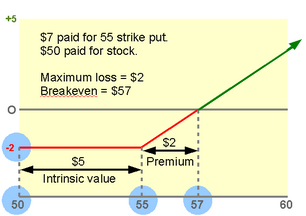

One way to reduce the maximum risk of a 'married put' position is to use a strike which is above the price paid for the underlying stock. For example; instead of buying the 50 strike put option, we could consider the 55 strike put option. Let us take a look at how this changes things, still assuming that we paid $50 for the underlying stock.

Our first consideration is the cost of the put. If the strike is now 55 then we are insuring that we can sell our stock for $55. Were someone to give us this put option for free, we could, therefore, instantly exercise the option to sell our stock for $55, pocketing a $5 profit. Of course, life is never quite so generous, and such fairy godmothers do not exist in the world of options trading. However, the *real* cost of the put is reduced.

We now have a $5 difference between the stock price and the strike. This is called the 'intrinsic value' of the option. It would be the basic 'price' for the 55 strike put option, but provide no incentive for the put seller to actually take the risk. Therefore, an incentive is paid over this intrinsic value. This is the premium.

We now have a $5 difference between the stock price and the strike. This is called the 'intrinsic value' of the option. It would be the basic 'price' for the 55 strike put option, but provide no incentive for the put seller to actually take the risk. Therefore, an incentive is paid over this intrinsic value. This is the premium.

The good news is that the required premium falls as we move above the stock price to use higher strikes for our put option. The 50 strike had no intrinsic value and so the $3 price was ALL premium.

Let's assume that the seller requires just $2 premium for a 55 strike put. Of course, he also requires the intrinsic value of $5, so the total 'cost' of the put would be $7.

Why on earth would we pay $7 for insurance rather than $3? Surely the return of our $50 is the extent of insurance we require and we achieved that for only $3 using the 50 strike.

Why bother with the 55 strike?

The $5 intrinsic value of the put option will never be lost as any loss in value to the put?s intrinsic value is equally offset by the rise we enjoy in the underlying stock. Therefore, the only RISK we have is, again, the premium paid for the put option. In essence, we have reduced our maximum risk from $3 down to $2.

Yet higher strikes would reduce the premium even more, but the benefit to our risk has a trade?off to consider in the effect on our breakeven price. The stock must achieve more in order for us to make a profit. In fact, the $1 benefit we gained by lowering our maximum potential comes at the expense of a $7+ move now being required to make a profit on the position - our purchase price for stock of $50, plus the $7 paid for the put.

It may seem odd, then, that I countenance using higher put strikes for the married put position, when the disadvantage of a higher breakeven appears to outweigh the benefit of a slightly lowered risk. There is one answer, but many ways to achieve the goal - the aim is to build a stronger and potentially more profitable foundation for the exciting adjustments to be made on the position as the underlying stock price changes. More on that in my other articles and videos.

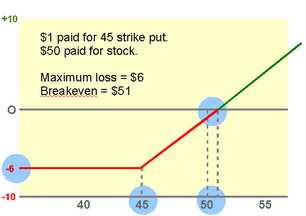

Of course, there is also the idea of buying a strike lower than the stock price to consider. The initial outlay would certainly be cheaper, and the effect upon our breakeven price would be less restrictive, but the maximum risk increases dramatically. Unfortunately, there is rarely a 'free lunch' in the options market, although sometimes one does pop up, as we will see in my other articles.

Of course, there is also the idea of buying a strike lower than the stock price to consider. The initial outlay would certainly be cheaper, and the effect upon our breakeven price would be less restrictive, but the maximum risk increases dramatically. Unfortunately, there is rarely a 'free lunch' in the options market, although sometimes one does pop up, as we will see in my other articles.

Let's take a look at a position using the 45 strike put option instead of the 50 or 55 and assume a $1 cost for the option. This $1 is, of course, entirely premium as no intrinsic value remains between the stock price and the option strike.

As we can see the risk is increased dramatically. The stock must bear the first $5 of loss before the put option provides any protection at all. Add this to the $1 paid and the maximum risk rockets to $6.

Breakeven, however, is only raised by $1 so the stock has less gap to fill before making a profit. This type of position is useful as insurance against catastrophic loss, but the amount at risk is usually too high for use in my favourite strategy. I prefer to set tight limits on potential loss at the beginning, then let my various adjustments to the position eradicate risk, and turn in a profit, as events unfold.

I sleep better for that, and find the results to be greatly improved.

For me the 'married put' is the secure foundation of what often becomes a 'profit machine'.

In part 3, we'll look at timing an entry - with a real example and data to prove the point.

You can jump to Part 3 of this series by clicking below...