Stock Market - Momentum and Volatility

Should a stock be bought when rising, or falling?

The momentous tale of Stock A and Stock B........

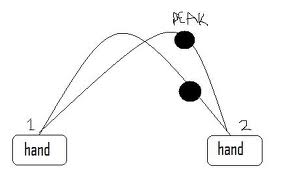

Let us imagine a juggler, using two - identical - tennis balls.

His unimaginative exhibition is less important than our observation that, at some point, the two balls will be at exactly the same height - with one going up, and the other coming down.

Both are moving under the momentum of exterior forces.

The same could even be true of four, eight, or any number of balls under such a scenario. At any one price several variations of momentum could be in play.

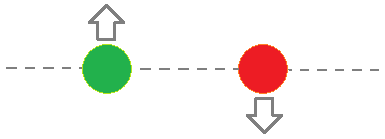

In terms of an absolute price, what is the difference between a stock that is rising and a stock that is falling? If you believe that the 'true' value of that stock is much higher than the current price, then how does the recent history and current momentum of a stock's price action affect your decision to buy?

The anser, of course, depends upon your personality and your psychology towards the stock market and investing in a business portfolio model that includes stocks and shares. Is the current 'glass' half empty, or half full?

Like 2 balls in the air simultaneously, currently at the same height, the true picture only becomes clear with more information... generally only available in hindsight!

It would be a simple decision to invest in buying stock that is falling if one were sure that it was about to bounce and head back up again to levels higher than our purchase price. And it is tempting to visualize that scenario to justify purchasing stock that has fallen considerably already. The infamous "catch a falling knife" method of investing in stocks. ;)

Conversely it may be, naturally, tempting to use the 'rule' that 'stock price momentum continues until a catalyst chages its direction' to justify buying into a stock that has already risen but appears to be 'on a roll'. However, where is the catalyst that could change the momentum, and when will it hit? Again, only hindsight, or wild delusions of one's ability to time the markets, can help us to decide.

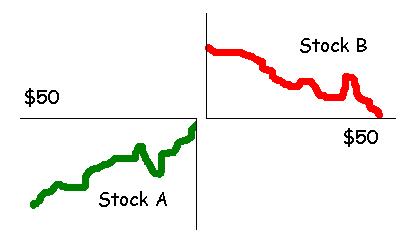

Your style of investing - would you buy stock A, or stock B, at $50?

Some rules:

- 1. Nope - you don't get to see the rest of the chart. It is irrelevant.

- 2. There is no 'right answer' - your choice simply reflects your style.

- 3. EVERYTHING is considered to be equal, except for the recent momentum.

- 4. Both stocks are considered to be fundamentally undervalued at $50.

- 4. Neither stock has any tangible reason for the recent price action.

Harder than you think, isn't it?

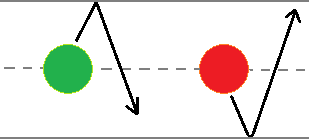

Stock A is more expensive than you could have bought it for, but some see this as a 'rolling wagon' (momentum') to jump aboard.

Stock B is cheaper now - a 'bargain!' To value investors this often looks good, but momentum traders see a 'falling knife'.

Is trading momentum and volatility relevant to married puts

Yes, it is. Very much so.

For a full explanation as to why, please the article Married Put Portfolio Strategy (Part 3)

In brief, however, the reason is as follows:

A married put strategy employs stock 'married' to a put option which protects the stock from catastrophic losses.

As the put options and stock price trade independently the relationship between a put option and the underlying stock can vary dramatically. this affects the overall maximum risk of the combined stock and put option strategy.

Example of volatility and momentum affecting Married Put risk pricing

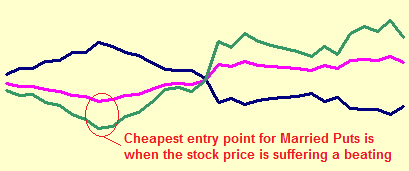

| Blue line = Price of 40 strike put option. |

| (Ranges from 8.65 to 11.45) |

| Pink line = Current stock price. |

| (Ranges from 36.64 to 43.63) |

| Green line = Maximum risk |

| (Low is good - Ranges from 809 to 1228) |

From the example using Freeport McMoran (FCX) from some years ago, we can see that a combined stock and put strategy could have a potential maximum loss of anything from $809 to $1,228... a difference of 40% on the risk carried by the buyer! That is absolutely incredible. O focurse, we would want the less risk option of $809, and to get it we would buy the stock on a heavy down day as the discount seen on the stock price will show up faster than the corresponding increase in the price of associated put options.

In that sense, then, the answer to our earlier dilemma regarding stock A vs stock B is, for Married Put buyers, that Stock B is the better opportunity as the put option/stock ratio will provide a less costly overall entry price to the new position.

The best time to enter a Married Put position is when the stock price is taking a beating, as shown in the chart, above. This is in spite of the put options being at their maximum cost price! Overall, a dramatic downward move in stock stock price will 'outrun' the corresponding increase in the price of put options. Momentum is helping to drive down the stock price, but put option buyers are generally looking at the potential for a rebound and so 'underprice7 the options compared to when the stock price is rising. when the price is rising, put option buyers tend to anticipate the end of momentum and so put options hold their value better than the rising stock price might suggest. Hence the volatile nature of the maximum risk to enter a married put position.