Section 3 - Reduce costs

If protective put options were given away free of charge to any investor requesting them, I doubt that anyone would refuse the offer.

Such 'stock paradise' is unlikely to emerge as risk usually demands a premium, but the example does, perhaps, demonstrate that buying 'insurance' to limit risk in the stock market is, quite simply, 'all about the cost'.

'Horses for courses' - call options or married puts?

I have been challenged several times to explain why a 'married put' position is preferable to simply buying a call option at the same strike price. A call option generally provides the same risk profile as a similar strike 'married put', but requires considerably less capital to set up.

I do use call options to reduce cost, but only when I consider it to be appropriate.

Let us consider the 'married put' example from the "CONTROL RISK" section of this site;

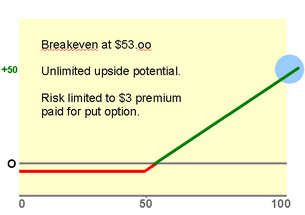

$50 paid for stock with $3 paid for a 50 strike put option would provide a maximum risk of $3/share and a 'breakeven' for the stock at $53. It would require $5,300 to hold 100 stock with one put option under this scenario.

$50 paid for stock with $3 paid for a 50 strike put option would provide a maximum risk of $3/share and a 'breakeven' for the stock at $53. It would require $5,300 to hold 100 stock with one put option under this scenario.

A call option at the 50 strike, however, would be priced close to the put option price. Let's say that it also costs $3. Again, the maximum risk would be $3/share and breakeven at $53 but the required capital would be a mere $300 to control a '100 share' position.

On the face of it, the call option looks like a much better deal.

However, I prefer the use of 'married puts' to initiate a position.

Naturally, at some point along the journey, I do often replace the 'stock and put' combination with a straightforward call option, both to lower the amount of capital tied up and, therefore, improve the potential percentage returns on the position. It is obviously better to make $1,000 profit from an investment of, say, $300 in a call option, than to require $5,300 to achieve the same potential, especially if the maximum risk is almost equal in both cases.

Some of the reasons for my choice are proprietary, but the reasoning is, I assure you, sound. It mainly boils down to the idiosyncrasies of options market pricing and which type of position will suit me best if the stock subsequently makes a dramatic move in either direction, particularly if it crashes.

A deep-in-the-money 'put' is, I find, far easier to adjust than a far-out-of-the-money call option. Options purists and 'experts' will disagree and quote Greek to counter the argument, but that is based upon theoretical pricing and I prefer to live in the real world. Markets do not run on theory, but on the real factors of fear, greed, and any opportunity to take advantage of investors like you and I. Wherever possible, I avoid being trapped at the mercy of an options market-maker where I might be one of very few people looking to trade that particular option strike at the time.

Stock Dividends' relation to Stock Option positions.

Perhaps the best reason for using a 'married put' position over a call option presents itself on stocks that pay a dividend....

- A call option is not eligible for dividends. Aside from any boost in the stock price following positive dividend news, investors will prefer to buy the stock, or exercise their call options to get stock, in order to be eligible for the dividend. Call option holders, however, can only hope that a rally ensues to make their investment hold its value.

- Nothing shoves premium into a put option like adjustment to a dividend; which is great if you have a 'married put' position as the extra premium helps improve the relationship between your stock and the put options.

- The price of 'puts' includes premium to reflect dividends.

- Click link for: Explanation of dividends, ex-dividend, the downward adjustment on ex-dividend day, and the effects of dividends on short-sellers and options.

- If the dividend is greater than anticipated, the additional downward adjustment of the stock price on ex-dividend day lights a fire under the premium in associated put options yet gives a reason for the stock itself to climb. Not a bad result if you find such an event.

- If, however, a dividend is slashed, or even cancelled, (2009 will see many dividends cut), the potential negative effect on the stock price will also tend to give 'put' buyers some reason to increase their taste for paying a premium.

Spotting a suitable opportunity to reduce capital requirement.

In conclusion, I prefer not to worry about the capital tied up in the initial position but scout for a suitable opportunity to reduce my required capital at a later date. Stock is, in my opinion, the best vehicle to reflect market volatility. In both a 'married put' position, and a call option position, we want the underlying stock price to move - a sideways grind is not a good basis for either position to be turned into a profitable venture. Stock captures the moves 100%.

Amending the position from 'married puts' to call options is just one of the strategies I use to reduce the 'cost' of a position, and call options do have their place in my portfolio. The debate over which is the best type of position, however, generates some controversy amongst stock investors and options-only traders. I have my own style and it works well for me. If it didn't, I'd take the 'cheap' option and use calls exclusively.

Transferring a 'married put' to call options can be an effective way to reduce 'cost', at the right time, but other tricks I have up my sleeve often prove far more important to the results I achieve.

You can jump to the main parts of this series by clicking below...