Married Put Strategy - part 1

The 'married put' is a position which seems counter-intuitive to the general optimism which accompanies the purchase of stock but, like insurance, it pays to think ahead and to have a plan. 'Hope' is not a valid investment strategy.

The 'married put' is a position which seems counter-intuitive to the general optimism which accompanies the purchase of stock but, like insurance, it pays to think ahead and to have a plan. 'Hope' is not a valid investment strategy.

This series of articles begins at an introductory level in part 1, but quickly progresses in subsequent articles to more intricate details and several 'tricks of the trade' generally overlooked even by options experts.

Let's get married!

Not literally, of course, but let's take a look at a married put position that might become part of a good business portfolio strategy.

The criteria for this example are....

The criteria for this example are....

1.Buy stock at $50

2. Buy a 50 strike put for $3

This gives us the right to sell the stock at $50. Of course, the counter-party selling this 'insurance' option to us requires a payment for taking on the risk. This is the premium paid for the option.

3. The position, in this example, will have been held to expiry of the put option.

Time decay and price movement of the stock will affect the value of the put option on a daily basis. However, for this part of the story, I am considering only the 'bottom line' value and implications of the 'married put' position.

4. No further adjustments are included at this stage - but opportunities are going to appear.

Having established the basics of this strategy, the news only gets better. With a position in play, and 'insurance' limiting any potential losses to an amount we feel comfortable with, the real power of this strategy can begin.

The numerous strategies to reduce risk to zero or less and maximize income potential are covered in my later articles and videos but, for now, I am just trying to make sure that we have the basics down, understand how to establish a foundation position, and can visualize the underlying fundamentals of a 'married put' position.

Charts explaining option positions are generally laid out as follows....

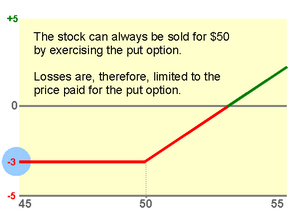

Stock price is displayed along the bottom, with the profit/loss of the position displayed on the left. This puts the focus on how profit and loss evolves as the stock price varies over time. With even the most comlex trading software, this simple layout is, basically, what is going on.

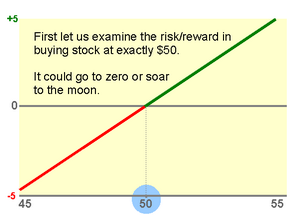

First, let us consider the risk/reward ratio of buying just the stock, for $50 per share. Our breakeven is $50 and our profit/loss potential ranges between 100% loss and unlimited upside. The stock could go to zero, or to the moon. In our example, of buying stock at $50, a drop to $45 would give a $5 loss (Note the left scale) and a gain to $55 would provide a $5 profit.

Next, let us add a 50 strike put option to the position, and pay the counter-party $3 premium for the contract. The 'strike' is the price at which we can sell the stock to the counter-party at expiration - REGARDLESS of the actual price of the stock itself at that time. We do not have an obligation to sell the stock for $50 but we do have the option to force a sale at price if we so desire. To force a sale is called 'exercising' the option. The price of this convenience is the agreed premium of $3 for this example. Longer time periods will require higher premiums. There are many factors influencing the premium required for options pricing and much of this topic is shrouded in mystical language and terminology that suggests a complex mathematical formula. In practice, however, it is simple and much of the 'fancy7 language can be interpreted in a simple way. You can read about this in my article: Options pricing is easy.

Let's establish some assumptions from the above Married Put...

a). We can sell the stock for $50, even if it crashes, simply by exercising the put option.

b). Our maximum potential loss for the position is the $3 we paid for the option contract.

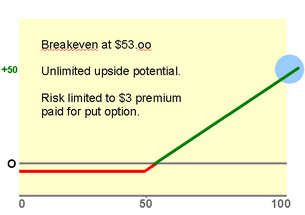

c). We have unlimited upside potential for the stock. If it shot up to, say, $100 we could sell it for $100. In this scenario, our put option would be unnecessary and the $3 we paid for the contract would simply become a cost to the position. In fact, the simplest way to describe this is that the breakeven for our position rose from the $50 price we paid for the stock, to $53 including the 'wasted' $3 premium we paid for insurance.

In conclusion, let us summarize the position as it stands....

- We have a MAXIMUM risk of $3.

- We have UNLIMITED upside potential.

- We have a BREAKEVEN price for the position of $53.

- We have a FIXED TIME period for the position.

- We have a FOUNDATION on which to build a profitable position.

Now, imagine if we could reduce the 'cost' of the put to zero... or less.

The aim of my method is to create a position which has NO risk at all but still has upside potential if the stock continues to climb, and income potential even if the stock only trades sideways.

In part 2 of this series I'll discuss how to choose the right strike price. Part 3 explains the best way to time an entry, and further parts analyze in more detail the structure and adjustment of a foundation position to create a limited risk base upon which to build an 'income machine'.

You can jump to Part 2 of this series by clicking below...